Our Strategies

Performance & Returns

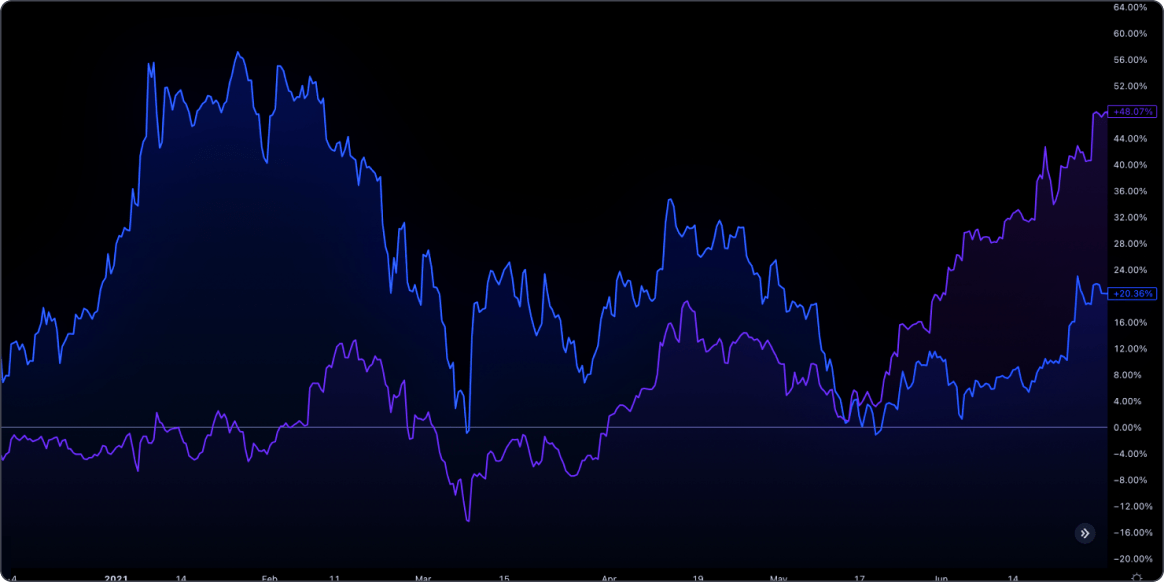

Hedge fund performance varies widely depending on the strategy and market conditions. They often aim for absolute returns, meaning they seek to make a profit regardless of overall market performance.

Hedge funds offer diverse investment opportunities with the potential for high returns but come with increased risk and complexity. Understanding these factors is crucial for making informed investment decisions.

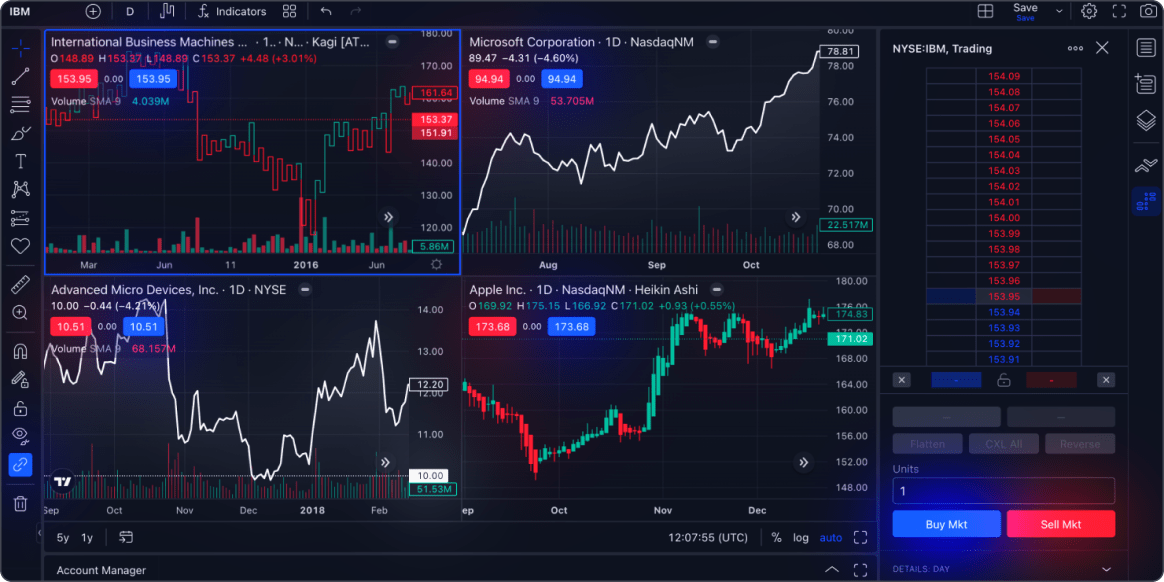

Common Strategies

- Long/Short Equity: Buying undervalued stocks while short-selling overvalued ones.

- Market Neutral: Aiming to achieve returns regardless of market direction by balancing long and short positions.

- Arbitrage: Exploiting price discrepancies between related securities.

- Event-Driven: Investing based on events like mergers or bankruptcies.

Risks & Considerations

- Leverage: Hedge funds may use leverage to amplify returns, which also increases risk.

- Liquidity: Investments might be less liquid compared to other assets, with lock-up periods and redemption constraints.

- Complexity: The strategies used can be complex and may involve higher risk.

Key Terms

- Alpha: A measure of an investment's performance relative to a benchmark index.

- Beta: A measure of an investment's volatility in relation to the market.

- Drawdown: A decline in the value of an investment from its peak.